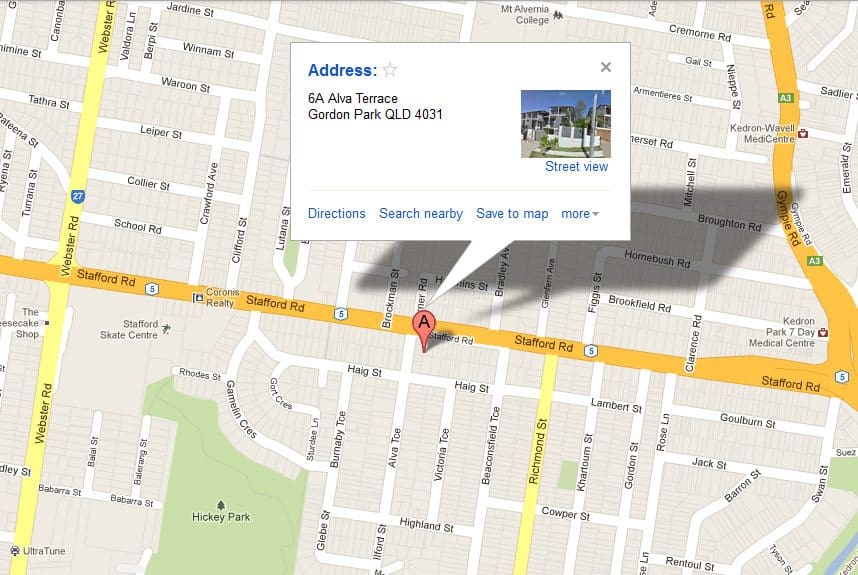

To purchase an Investment property (up to $550K) within 10km of the Brisbane CBD that is likely to achieve strong capital growth, good rental returns, has minimal out-of-pocket expenses and no hassles!

Strategy: Buy and Hold.

| Gordon Park | Houses | Units |

|---|---|---|

| Medium Value (2012) | $598,500 | $351,000 |

| Average Growth Rate (last 10 yrs) | 7.2% | 7.5% |

| Current Rental Yield (Sept qtr) | 4.6% | 5.2% |

Suburb Statistics (Residex Nov 2010)

| Investment Costs: | |

|---|---|

| Purchase Price | 492,000 |

| Purchase Costs (stamp duty, loan fees etc) | 17,265 |

| TOTAL INVESTMENT COSTS | $509,265 |

| Loan: | |

| Loan Amount | 502,265 |

| Interest Only Loan | 5.8% |

| TOTAL LOAN PAYMENT (P.A) | $29,537 |

| Property Income Expenses: |

|

| Rental Income (2% Vacancy Rate) PA | 25,480 |

| Rental Expenses (Management fees, rates etc) | 4,938 |

| Net Rental Income (Rental Income – Expenses) | $20,542 |

| Pre-Tax Cash Flow: | |

| (Net Rental Income – Total Loan Payments) | -8,996 |

Cash Deductions

|

|

Depreciation

|

|

| Capital allowances | 4,408 |

| TOTAL TAX DEDUCTIONS | $46,137 |

| Tax Credit Calculation: |

|

| Tax Loss (deductions – rent) | 20,822 |

| Marginal Tax Rate | 37% |

| Tax Credit (Marginal Rate x Tax Loss): | 7,704 |

| Annual After Tax Investment (pre-tax cash flow + tax credit): |

$1,292 |

| WEEKLY AFTER TAX INVESTMENT | $25 |

Or call us on 0422 303 103