To achieve maximum capital growth and rental returns.

Strategy: Renovate and Sell.

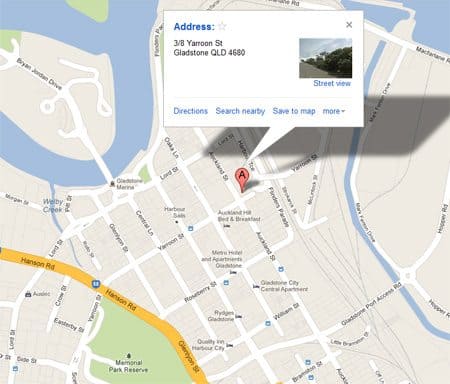

Gladstone is a coastal port in Central Queensland, approximately 550km north of Brisbane.

Gladstone is a major economic powerhouse with established industries in coal and aluminum processing and export, concrete and energy production. Massive future growth is predicted with the construction of multi-billion dollar liquid natural gas (LNG) pipelines and the infrastructure needed to support them.Gladstone’s growing population and their demand for housing has seen significant increases in property prices and rental returns.

| Gladstone | Houses | Units |

|---|---|---|

| Medium Value (2012) | $439,500 | $340,500 |

| Average Growth Rate (last 10 yrs) | 11.4% | 15.3% |

| Current Rental Yield (Sept qtr) | 5.4% | 5.9% |

Or call us on 0422 303 103